In the US, cannabidiol (CBD)-related laws vary by state. While CBD-infused food and beverage products containing up to 0.3% CBD per container have been legalised across 15 US states (including New York, California, and Texas), the absence of a uniform national regulation is challenging for the beverage industry and could be holding back investment.

Earlier this year, the US Food and Drug Administration admitted the regulatory framework for CBD foods and supplements was not appropriate and the agency said it was prepared to work with the US Congress to develop a new framework for CBD products.

CBD is a chemical compound found in the cannabis plant that has little or no psychoactive properties of tetrahydrocannabinol (THC), the cannabis compound that causes a “high” when consumed.

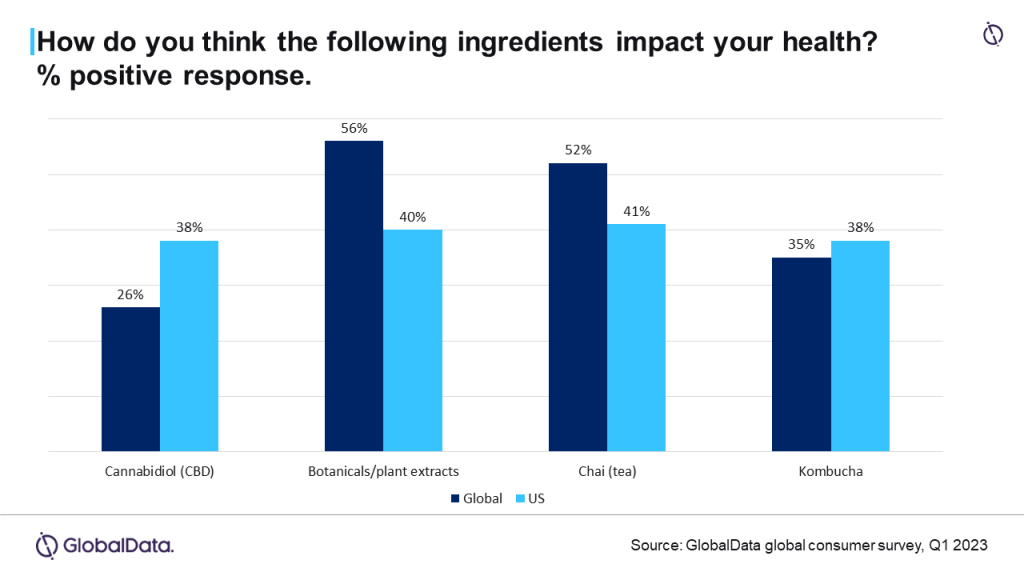

US consumer perceptions of CBD more positive than global outlook

According to a GlobalData survey of global consumers in the first quarter, over a third – 38% – of US respondents believe CBD has a positive impact on health, which is a far more positive stance on the ingredient than the global average of 26%. CBD’s perceived positive impact on health in the US is comparable with other ‘healthier’ ingredients such as botanicals/plant extracts, chai and kombucha.

This positive perception of CBD by a substantial cohort of US consumers is supporting innovation and the expansion of product distribution from small to mid-sized local industry players. In April, Cann, a California-based non-alcoholic cannabis beverage brand, launched the drink in New York. In June, Chicago-based NuEra Cannabis and Two Brothers Artisan Brewing Co. joined forces to launch RisEau – a CBD-infused seltzer and, in the same month, cannabis beverage brand Uncle Arnie’s launched their iced tea lemonade flavours in Nevada.

Like many other categories, the US CBD market has been impacted by macroeconomic factors such as high inflation and the resulting cost of living crisis. This has limited consumer spending and made it difficult for manufacturers to raise capital. Some larger industry players’ CBD initiatives have stalled over the last 12 months. Molson Coors announced in November 2022 it was to exit both the ready-to-drink and CBD beverage categories citing that “no near-term pathway to federal legislation” was behind the company’s decision.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataConstellation Brands also cited stalled federal legislation preventing the level of category growth hoped for when it made a $1.1bn write-down in the value of its investment in cannabis producer Canopy Growth in October 2022.

CBD product benefits can be hard to quantify for many but for loyal consumers they include helping relaxation, providing a feeling of calmness and an uplift in mood. The US market has seen the most success in hard seltzers which is a low-alcohol category and CBD drinks might be an adjacent category to low/no alcohol that could interest consumers for similar reasons. Additionally, CBD-infused drinks have a key functional benefit for alcoholic beverage consumers as they can provide the boost in mood that drinkers enjoy from alcohol without the adverse side effects such as a hangover.

“Increasing awareness of the importance of mental wellbeing is providing a boost for CBD-infused drinks from some consumer cohorts,” Vineeta Rai, senior beverages consultant at GlobalData, Just Drinks’ parent says.

Rai points to a GlobalData consumer survey in the second quarter of the year. “Three out of four global consumers consider ‘good for mental wellness’ as either essential or nice to have when considering a product purchase,” he/she explained. “As health considerations exert a growing influence on people’s food and drink choices, consumers are seeking products like CBD-infused beverages that can help them meet their personal health goals, particularly relating to mental wellbeing.”

Given the growing interest in CBD-infused products, the FDA plans to work with Congress to deliver a consistent national framework that includes safeguards to mitigate risk, clear labelling transparency, the prevention of contaminants, CBD content limits and a minimum age restriction on product purchases.

The rate of growth enjoyed by US manufacturers of CBD food and beverage products could well be determined by the outcome of discussions that are due to take place in Congress over the coming months. The US CBD market will be watching proceedings with interest.

Rai adds: “With a potentially sizable consumer cohort in the US for CBD-infused products and with beverage companies still pressing ahead with new product launches despite the uncertainty, US food and drink manufacturers will be hoping that Congress and the FDA can find a way to reach a regulatory agreement sooner rather than later.“

GlobalData combines in-depth technology and sector-level expertise in 20 of the world’s largest industries. Our consultants use this expertise to answer your bespoke questions with a custom solution that is tailored to your budget, timeline, and specific scenario. At GlobalData Consumer Custom Solutions, our consultants and analysts will work closely with you to understand your requirements and develop a tailored proposal and deliverables. Email us at consulting@globaldata.com or get in touch here.