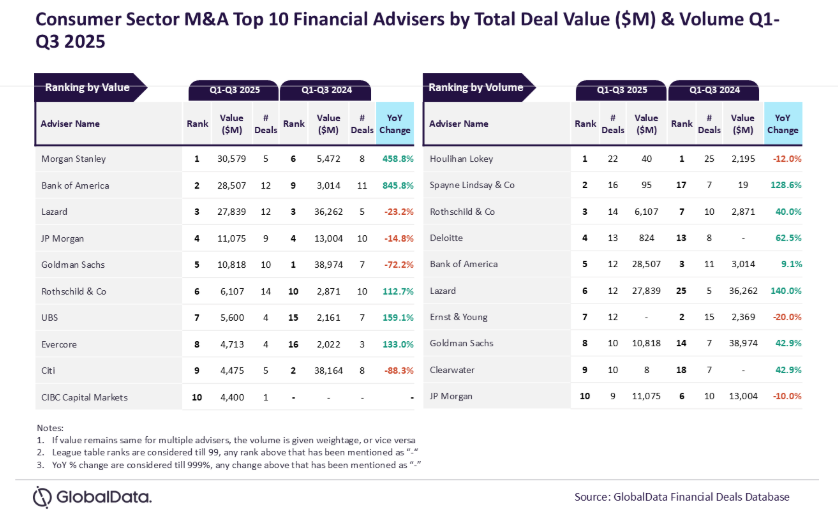

JP Morgan and Houlihan Lokey ranked first in two league tables devised by GlobalData after analysing the M&A that took place in the consumer sector in the first nine months of the year.

According to GlobalData, Just Drinks’ parent, Morgan Stanley headed the charts of financial advisers when measuring the value of transactions while Houlihan Lokey advised on the most deals.

Morgan Stanley worked on deals in the consumer sector worth a cumulative $30.56bn. Houlihan Lokey was appointed an adviser on 22 transactions.

In August, Morgan Stanley was contracted on Keurig Dr Pepper’s move to acquire Dutch coffee company JDE Peet’s for €15.7bn ($18.36bn) and then split the combined business into two.

The thrust of Houlihan Lokey’s work came in food, including Kraft Heinz’s sale of a clutch of assets in Italy to NewPrinces in July.

Aurojyoti Bose, lead analyst at GlobalData, said: “Houlihan Lokey was the top adviser by volume during Q1 to Q3 in 2024 and managed to retain its leadership position by this metric during Q1 to Q3 in 2025, despite registering a year-on-year drop in the total number of deals advised by it.”

In the first nine months of 2024, Houlihan Lokey advised on 25 transactions, the GlobalData figures showed.

When measuring the value of deals, Bank of America ranked second, advising on $28.51bn worth of transactions.

Lazard followed, working on 12 deals worth a combined $27.83bn, then came JP Morgan on $11.08bn and Goldman Sachs on $10.82bn.

In terms of deal volume, Spayne Lindsay worked on 16 transactions, followed by Rothschild & Co. on 14, Deloitte on 13 and then a pair – Bank of America and Lazard – on 12.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources. A team of analysts gathers in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.