US distillers saw their export sales drop 9% in the second quarter, with declines across key categories, according to data released by trade body DISCUS.

The value of US spirits exports stood at $593.6m in the three months to the end of June versus $651m in the corresponding period a year earlier.

Announcing the figures, US trade association Distilled Spirits Council of the United States (DISCUS) blamed “rising trade tensions”, highlighting an 85% slide in sales to Canada during the second quarter.

From the start of March until September, US spirits producers faced a 25% tariff on exports to Canada after Washington’s imposition of duties on products from north of the border.

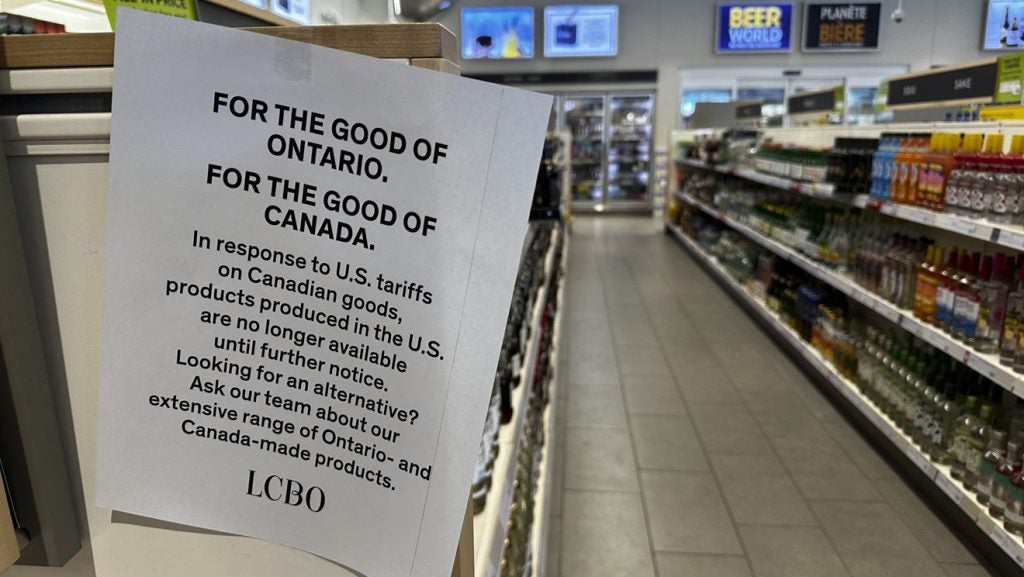

The US tariff on Canadian goods led to provincial governments removing American spirits from liquor store shelves.

Alberta and Saskatchewan provinces ended their bans in June but US products remain barred elsewhere.

Canada removed the 25% tariff on 1 September. DISCUS said Canada remains the only “key trading partner” to retaliate against US tariffs by imposing measures on American wares. However, sales of US spirits also fell in the EU, the UK and Japan during the second quarter.

Exports to the EU – the largest market for US spirits – fell 12% to $290m. Sales in the UK dropped 29% to $26.9m and in Japan declined 23% to $21.4m.

“After celebrating a record year for US spirits exports in 2024, this new data is very troubling for US distillers,” DISCUS president and CEO Chris Swonger said. “Persistent trade tensions are having an immediate and adverse effect on US spirits exports. There’s a growing concern that our international consumers are increasingly opting for domestically produced spirits or imports from countries other than the US, signalling a shift away from our great American spirits brands.”

Unsurprisingly, whiskey accounts for just under half of US spirits exports and sales slid in the second quarter, falling 13% to $272.9m.

Sales of cordials dropped 15% to $105.8m, while vodka exports decreased 14% to $69.1m.

Swonger said American whiskey producers are facing a slowdown in domestic sales and record-high inventory levels. Since 2012, American whiskey inventories have tripled, reaching nearly 1.5bn proof gallons by the end of 2024, DISCUS says.

He added: “With domestic demand slowing, it is critically important that US distillers have the certainty of zero-for-zero tariffs with our key markets, including the EU and UK.”

Spirits sales in the US remain muted. In the 12 months to the end of August, spirits sales fell 1.8% to $13.37bn in the 18 control states in the US measured by the National Alcohol Beverage Control Association (NABCA). Volume sales dipped 0.9% to 60.7m nine-litre cases.