Following a global pandemic in 2020 and the ongoing conflicts between Russia and Ukraine as well as Israel and Palestine, barring some notable exceptions, inflation rates have generally been easing in 2024.

However, as a result of such uncertain economic situations, global consumers have cut their spending on non-necessities such as alcoholic beverages, according to a new report from Just Drinks’ parent group GlobalData.

Approximately 30% of global consumers now describe their spend on alcoholic drinks as “low”, with the beer category particularly seeing a sharp increase in consumers spending less than in 2022.

The data is based on 13 “key markets”, which include the US, Mexico, Brazil, Argentina, the UK, Germany, Sweden, China, India, Australia, Singapore, South Africa and the UAE.

Thirty one per cent of consumers described their expenditure as “low” for beer specifically compared to 25% two years ago. Meanwhile, the number of people who labelled their spend on beer as “high” fell from 23% to 17% this year.

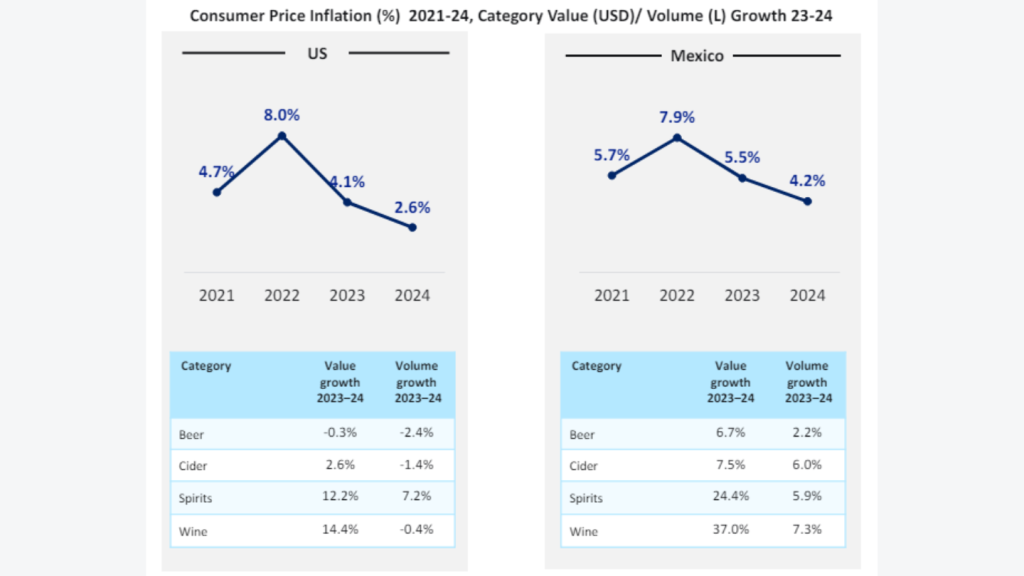

The drop in how much people are spending on alcohol is not entirely surprising when looking at the factors driving the value growth of alcoholic drinks in the markets which GlobalData analysed.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

In Mexico, for example, the value of the country’s spirits market grew 24.4% from 2023 to 2024 while wine surged 37%. However, in terms of volume, the two categories only grew 5.9% and 7.3% respectively.

Value growth exceeded volume growth in beer, cider, spirits and wine in the US and Mexico over the last year, among several other countries like the UK and Germany. The GlobalData report claimed the reasoning for this was twofold.

Firstly, it is partially indicative of the surge in the ‘premiumisation’ trend in alcoholic drinks, which is where companies attempt to increase the appeal of its products by focusing on its higher quality and therefore charge more.

The other explanation is “significant inflationary price spikes” from drinks companies as consumer demand has sunk in recent years, due to ongoing alcohol moderation trends and a cash-strapped consumer.

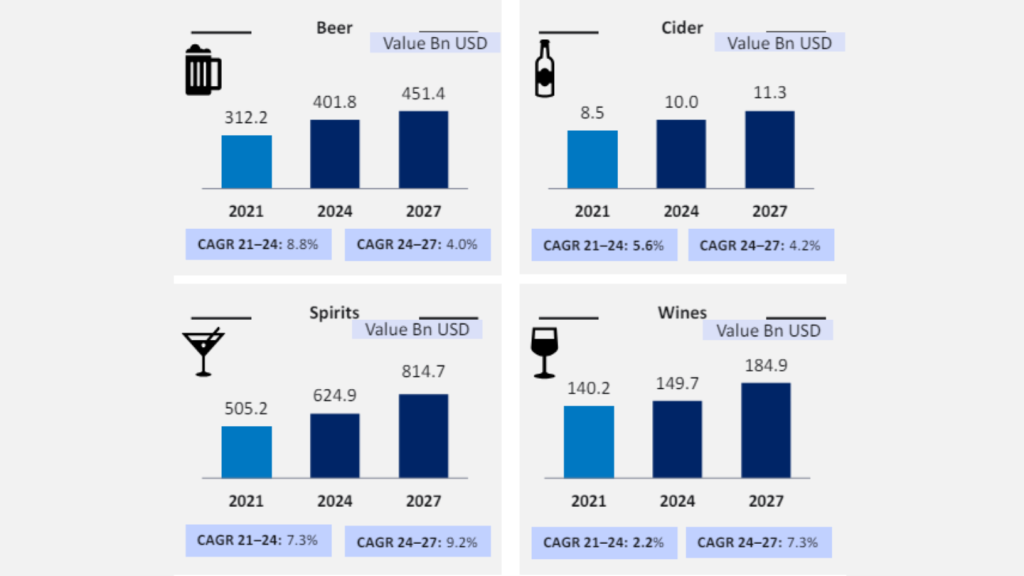

These two main reasons will be the drivers behind forecast positive compound annual growth rates (CAGR) in terms of value for GlobalData’s four alcoholic drinks categories.

The group reported that beer, cider, spirits and wine are all set to experience a positive CAGR between 2021 and 2024, and it has estimated that each category will continue sustained growth until 2027.

The spirits category appears as a leader, with a forecasted CAGR value between 2024 and 2027 of 9.2%. It will be closely followed by wines, with a CAGR of 7.3% during the same period.

Meanwhile, beer and cider categories lag with growth of 4% and 4.2% respectively.

“A continuous rise in value can indicate the premiumisation of products, which might be particularly applicable to the wines and spirits categories, already associated with high quality and premium options”, the report wrote.

“However, the inflationary price spikes and cost increases on the suppliers’ side can also be responsible for the future rise in value.”

The consumer spending analysis report also indicated supermarkets and hypermarkets have become a clear leader among channels that sell alcohol, with 34% of global consumers choosing them.

The next best channels were convenience stores and online retailers, with 11% and 10% rates respectively.

The report said: “Supermarkets might be the leading channels not only due to the convenience of buying alcoholic drinks along with other consumer goods, but they can also usually offer lower prices compared to privately owned or independent businesses.”