Alongside our daily news coverage, features and interviews, the Just Drinks news team sifts through the week’s most intriguing data sets to bring you a roundup of the week in numbers.

Non-alcoholic-spirits drinkers could turn to on-premise in US

The value of non-alcoholic spirits sales in the on-premise in the US is set to surpass the off-trade in 2025, data shows. In volume terms, restaurants and bars will also start to narrow the gap on retailers.

Since the pandemic, the value of sales in the on-premise has been lower than in the off-premise, having been higher in 2019, according to analysis by GlobalData, Just Drinks’ parent company.

By 2027, the on-premise could be worth $6.84m and sell 150,000 litres out of a total 360,000 litres of non-alcoholic spirits.

The off-premise, meanwhile, is set to be worth $6.46m and sell 210,000 litres.

GlobalData analysts told Just Drinks: “Sales of non-alcoholic drinks are soaring due to improved quality and taste, flavour innovation and the introduction of new brands in the markets.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“There were 72 non-alcoholic drink SKUs introduced in the US market between mid-July of 2021 and 2022.

“Along with this, the increase in disposable income and health consciousness has shifted the consumer taste from traditional drinks to no/low-alcoholic drinks.” They added e-commerce is set to “propel” market growth in the next three years.

As wine consumption falls, could branding be the answer?

Global wine consumption has been dropping gradually since 2007, a trend that is accelerating. An estimated 2m hectolitres less wine was drunk in 2022 versus 2021, according to the International Organisation of Vine and Wine (OIV).

Global wine production is predicted to hit a 60-year low in 2023. Rather than panic, the OIV suggested this could bring “equilibrium” to the market amid oversupplies and falling consumption.

This week, we spoke to wine producers, consultants and marketing experts about one theory behind diminishing numbers of drinkers: wine branding.

A lack of a branded approach to wine is, some argue, the key reason wine is losing out to other categories.

Relying on an appellation model may work for historic regions like Bordeaux and for wine-educated drinkers who know their Butt from their Barrique, but for many the choices are uninspiring and confusing.

“Where wine isn’t actually losing customers is at the premium end,” says wine consultant Joe Fattorini. “There is analysis that suggests that wine is actually in growth in that premium part of the market. Where it’s really struggling is in the mass of people who say: ‘I don’t want to do the course, I just want to drink a bottle but none of them mean anything to me.’”

Germany not immune to falling wine consumption

And data released this week in Germany highlights the declining wine consumption seen across markets worldwide. Figures published by the German Wine Institute showed the amount of wine drunk per capita fell again in the last year.

Consumption fell from 19.9 litres per person to 19.2 litres, when comparing 1 August 2022 to 21 July 2023 against the corresponding period in the previous year.

“The changes in wine drinking habits in Germany are due to demographic change and changes in consumer behaviour, as well as the general loss of purchasing power due to the increased cost of living,” the German Wine Institute has stated.

Aside from a jump during the depths of the Covid-19 pandemic, Germany’s wine consumption has been trending downwards. Data from the German Wine Institute shows consumption in the calendar year 2022 was 19.9m litres per person, compared to a peak of 21.1 litres in 2016.

Wine consumption is on the wane in other western European markets, according to figures released by the EU Commission last year. For 2023, Portugal is estimated to have drunk 35% less wine compared to the previous year. France and Spain are also expected to see consumption decline by 22% and 15%, respectively.

Code red: Houthi attacks spark fresh supply-chain disruption

After the supply-chain upheaval of recent years, boardrooms would’ve been forgiven for hoping for some respite in 2024 but the early weeks of the new year have seen yet more disruption to global trade.

The latest boardroom headaches have their source in the Red Sea where the Houthi attacks have upended supplies through one of the world’s most important trade routes and caused companies across industries to reassess their logistics.

The retaliation from a US-led group of countries has added to the uncertainty in the region and the disruption has been further compounded by a drought affecting shipping through the Panama Canal.

The Red Sea/Suez Canal is important in world trade terms. It is said to handle 12% of global trade, while the Suez Canal accounts for nearly a third of the world’s container traffic. The re-routing of ships carrying goods from Asia to Europe and beyond means vessels are travelling 3,500 extra nautical miles around the Cape of Good Hope in South Africa.

So far, there’s little sense of panic in food and beverage circles, or at least not outwardly.

Just Drinks contacted more than 20 of the world’s largest food and drinks companies to ask how the disruption has affected their supply chains and most insisted they were monitoring what one senior executive described as a “very fluid situation”.

That said, as we detailed this week, some businesses were prepared to admit they have made changes to their logistics, while Italy’s principal farming organisation Coldiretti was especially vocal in expressing its fears about the country’s exports of fresh produce and wine.

Even if the larger food and beverage companies have so far been guarded about the impact on their operations, the disruption is sure to be a topic raised by investors as we head into results season in the coming weeks.

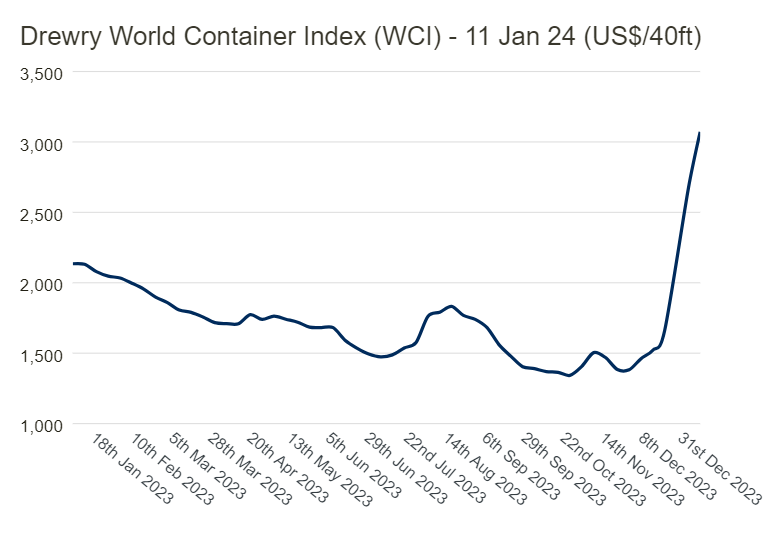

Maritime research and consulting group Drewry has reported a jump in the cost of container freight in the wake of the tensions in the Red Sea. Its most recent update, published on 11 January, showed a 15% increase in the cost of a 40ft container. Compared with the same week last year, the price had jumped 44%.

Carlsberg adds ‘craft’ to Danish stable

It emerged this week Carlsberg has acquired a minority stake in fellow Danish brewer Mikkeller.

Carlsberg, which dominates Denmark’s rather mature beer market, has snapped up a 20% stake in the Copenhagen-based brewer and bar operator.

The financial terms of the deal were not disclosed but the companies did announce Carlsberg would distribute Mikkeller’s brands in their home market.

“We will do what we can to help [Mikkeller] achieve even more success amongst customers and consumers in Denmark. We have an exciting portfolio of specialty beers and, with this partnership, we will be able to offer customers and consumers even more unique varieties in this category,” Peter Haahr Nielsen, the CEO of Carlsberg’s domestic business, said.

Carlsberg, home to the eponymous beer and brands like Tuborg, is, of course, the largest brewer in Denmark. The country, however, is a low-growth beer market, in both value and volume terms.

Nevertheless, that is not to say Denmark does not have an lively beer culture. According to data from trade body The Brewers of Europe, the number of breweries active in Denmark has grown steadily since the middle of the 2010s.

Kevin Baker, the global research manager for beer and cider at GlobalData, Just Drinks’ parent, describes Carlsberg’s investment in Mikkeller as “the classic ‘multinational teams up with craft’ scenario”.

He adds: “They already have a deal with Brooklyn for International Craft so this looks like a primarily domestic move. It’s also good for global brewers to ‘inject’ themselves with craft expertise and credibility.”

Princes profits sink

The UK food and beverage group, which has been the subject of takeover interest, this week filed its latest set of financial results.

Princes, owned by Japan’s Mitsubishi Corp., reported a loss attributable to its owners of £42.7m ($54.3m) in the 12 months to the end of March 2023 – against a profit of £17.2m a year earlier.

An impairment charge of more than £57.7m was central to Princes becoming loss-making during the period, accounts filed with Companies House, the UK’s business register, show.

The canned food and shelf-stable drinks manufacturer also pointed to higher finance charges and rising costs.

The numbers are significant as Princes has attracted suitors.

Reports emerged in January last year that Mitsubishi had appointed advisers to handle a possible sale of Princes, which it has owned since 1989.

Takeover speculation swirled around the Liverpool-based business throughout last year. Two weeks before Christmas, Newlat, the Italy-based food manufacturer, revealed it was in “very advanced” talks to buy Princes.

The bakery, dairy and pasta supplier’s statement came in the wake of a Sky News report that said Newlat was one of two remaining bidders for Princes, alongside UK-based private-equity firm Epiris. The buy-out house has not commented publicly on its reported interest in the business.

Tellingly, the Companies House report also states: “The directors, along with Mitsubishi Corporation, are reviewing the investment strategy of the business, which could lead to a sale.”