This regularly updated guide from Just Drinks will present the targets the world’s major drinks manufacturers have published on net zero – and the progress they have made so far.

According to the UN, the scientific consensus shows global temperature increases must be limited to 1.5°C above pre-industrial levels “to avert the worst impacts of climate change and preserve a liveable planet”.

To keep global warming to no more than 1.5°C – as called for in the Paris Agreement of 2015 – emissions need to be reduced by 45% by 2030 and reach net zero by 2050.

Companies link their net zero targets to three areas of emissions known as Scopes 1, 2 and 3. Under the internationally-recognised Greenhouse Gas Protocol, an organisation’s emissions are split into three ‘scopes’.

Scope 1 covers direct emissions from owned or controlled sources. A second, Scope 2, covers indirect emissions from the generation of the electricity, steam, heating and cooling bought and consumed by a reporting organisation.

Scope 3 includes all other indirect emissions that occur in a company’s value chain – and are the largest chunk of a drinks manufacturer’s output.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSome companies have sought to have their targets validated by The Science Based Targets Initiative, or SBTi. The organisation is a partnership between the Carbon Disclosure Project, the United Nations Global Compact, World Resources Institute (WRI) and WWF.

The SBTi aims to encourage the private sector to act on climate change by supporting companies and financial institutions to understand how quickly they need to reduce emissions to align with the Paris ambition of limiting warming to 1.5°C.

PepsiCo

The US food and beverage giant first formally set out emissions targets in 2021.

The goals were to cut “absolute greenhouse gas emissions across our value chain” by more than 40% by 2030, which includes a 75% reduction in emissions “from our direct operations”; and to “achieve net-zero emissions by 2040”. Those targets are based on a 2015 baseline.

In May 2025, PepsiCo announced a series of changes to its targets on emissions, packaging and, more broadly, net zero.

The US food and drinks giant is now aiming to hit net-zero emissions “by 2050 or sooner” compared to its previous goal of 2040 “versus a 2015 baseline”.

PepsiCo said it was “strengthening the resilience of its business and honing its focus to where it believes it can have the most positive impact”.

PepsiCo’s specific targets on Scope 1, 2, and 3 emissions link to its 2050 target. The company said the goals “reflect sectoral guidance” from The Science Based Targets initiative.

The Gatorade owner is looking to cut its Scope 1 and 2 emissions by 50% by 2030 versus a 2022 baseline. PepsiCo had been targeting a 75% reduction by the same year against a 2015 baseline.

On Scope 3 emissions, often the hardest for companies to tackle, PepsiCo has set out two types related to SBTi guidance: Energy and Industry (E&I); and Forests, Land and Agriculture (FLAG).

The group is aiming for a 42% decrease in E&I emissions by 2030 compared to 2022 levels, a goal that compares to a previous target of a 40% reduction by 2030 against a 2015 baseline.

PepsiCo’s goal for FLAG emissions also includes a new baseline. The company has a goal of reducing these emissions by 30% by 2030 when measured to a 2022 baseline. Its previous target was a 40% cut by 2030 versus 2015.

The changes PepsiCo set out in May 2025 on packaging included revisions on reducing virgin plastic and recycled content. It also pulled its target for “reusable” packaging.

PepsiCo is aiming to cut its use of virgin plastic by 2% year-on-year on average through to 2030. The company’s previous target was for a 20% decrease “derived from non-renewable sources” by the same year.

The group’s goal for its use of recycled content stands at a reduction of at least 40% “by 2035 or sooner”. It had been targeting using 50% of recycled content by 2030.

PepsiCo had been looking to “deliver 20% of all beverage servings through reusable models by 2030”, a target that no longer exists.

The company said it will focus on a wider goal for reusable, recyclable, or compostable (RRC) packaging by design. By 2030, PepsiCo is aiming for at least 97% of its packaging to be “RRC packaging by design … in our primary and secondary packaging in our key packaging markets”.

PepsiCo has broadened its goal for regenerative agriculture goal and said it is aiming for ten million acres by 2030, up from a previous target of seven million acres.

The company said it had “already delivered approximately 3.5 million acres”.

PepsiCo chairman and CEO Ramon Laguarta said: “Our goals must evolve with us to keep our ambition and to deliver on our long-term vision.”

Carlsberg

The Denmark-based brewer, home to brands including Tuborg, 1664 and Carlsberg, is aiming to reduce its “value chain emissions” by 30% by 2030.

By the same year, Carlsberg wants to cut its value chain emissions per hectolitre of beer and beverages by 30% from a 2015 baseline.

It also has a target of achieving “net-zero carbon emissions across our entire value chain by 2040”.

In a 2024 ESG update, issued for the first time alongside its financial results in February 2025, the group said it had “made steady progress… in every area of our ESG agenda”.

Carlsberg had originally planned to submit its 2040 goal for validation to the SBTi in 2024. However, according to its latest annual report for 2024, due to its acquisition of Britvic last year, the company has to assess whether it needs to recalculate its baseline and is therefore resubmitting its short- and long-term targets for absolute Scope 3 reduction.

On packaging, the company wants all of its packaging to be recyclable, reusable or renewable by 2030. Carlsberg, meanwhile, has set a target for 90% of its bottles and cans are collected and recycled after use. It has also cut its use of “virgin fossil-based plastics” in half and for its bottles and cans to contain 50% recycled content.

And, on agricultural sourcing, the company wants to have 30% of its raw materials to come “from regenerative agricultural practices” and be “sustainably sourced” by 2030. Carlsberg is aiming for all its raw material inputs to qualify as such ten years later. As of 2023, less than 1% of the inputs were deemed to meet the criteria.

In Carlsberg’s 2024 ESG report, the company said it saw a 2% reduction in absolute carbon emissions at its breweries year on year to 294,000 tonnes of CO2, a 58% drop since 2015. It also booked a 3% dip in relative value chain emissions compared with 2022.

Across the wider supply chain, it also booked a 3% dip in relative value chain emissions compared with 2022. Carlsberg said its “emissions per hectolitre of beverage” fell 60% on the 2015 baseline, (from 6.8kg CO2e/hl to 2.7kg CO2e/hl), which “emphasises the need for further focus on carbon reduction”.

Regarding agricultural sourcing, in 2024, the business said it was continuing to pilot its “transition” to regenerative agriculture in its France, UK and Finland markets. The group said it would begin to introduce barley grown “with some regenerative agriculture practices” into its beers in Denmark in 2025.

In terms of water waste, the business aims to hit “water usage efficiency of 2.0hl/hl globally”, while at its breweries in “high-risk areas”, the target level has been set to 1.7hl/hl. It is also looking to achieve “100% replenishment of water consumption” in its breweries in high-risk regions by 2030.

In 2024, the group launched water replenishment partnerships in Asia, and replenished 16% of water consumed at breweries in China, Laos, Cambodia and India.

Turning to packaging, the 1664 brewer said 76% of its bottles and cans were collected and recycled in 2024, a 4% increase on 2019. Some 43% of packaging material was made using recycled content, a 34% increase on 2022, while 94% of packaging was said to be “recyclable, reusable or renewable”.

In the same year, the group said it used 48,000 tonnes of virgin plastic down 21% on 2023 figures, and a 20% dip on its 2019 baseline of 60,000 tonnes.

Carlsberg has made some notables moves on packaging – ditching plastic on multi-can packs in markets including the UK and trialling a paper-based bottle for its namesake beer.

The Coca-Cola Company

In November 2024, US drinks behemoth The Coca-Cola Co. outlined a series of changes to environmental goals across emissions, packaging and water, sparking some criticism in campaign circles.

The new targets for 2035 replace a series of goals set for 2030. “We are prioritising goals and actions that seek to improve water security in high-risk locations, reduce packaging waste and decrease emissions,” a Coca-Cola spokesperson told Just Drinks. “These are complex, challenging areas and to help deliver on our progress, we need more time and more focused resource allocation on issues that are critical to our business and where we can make a meaningful difference.”

On emissions, Coca-Cola had previously set a goal to reduce absolute emissions by 25% by 2030 against a 2015 baseline. The company’s new target is to “aim to reduce the company’s Scope 1, 2 and 3 emissions in line with a 1.5°C trajectory by 2035, from a 2019 baseline”.

The spokesperson said the change in baseline “reflects more recent and improved data” and added the removal of a percentage target underlined Coca-Cola’s bid to focus its efforts.

“We are focused on the areas we have the biggest opportunities to make an impact. Key actions we intend to continue to take to reduce emissions include investing in energy-efficient coolers, increasing use of renewable electricity in our operations, incorporating more recycled material into our packaging and working with suppliers to help reduce their emissions.”

Asahi Group Holdings

The Japan-based drinks giant, home to a range of beer, soft drinks and spirits, has targets set for 2040.

Asahi wants to be “net zero” on Scopes 1, 2 and 3 by 2040, which the Super Dry brewer defines as “at least 90% emissions reductions and maximum 10% carbon removals”.

The group also has a clutch of shorter-term targets, measured against a 2019 baseline.

By 2025, Asahi is targeting a 40% cut in its Scope 1 and 2 emissions compared to 2019.

By 2030, the Nikka whisky distiller wants to have reduced its Scope 1 and 2 emissions by 70% against the 2019 baseline.

And, by the same year, Asahi is aiming to have lowered its Scope 3 emissions by 2030, again versus 2019.

Credit: Alex Tai/SOPA Images/LightRocket via Getty Images

In a progress report issued in June 2024, the company said it had met a 2023 target for Scope 1 and 2 emissions. It had wanted to cut those emissions by 30% when compared to 2019; Asahi said it had achieved a 32% reduction. Scope 3 emissions were cut 12% in 2023 compared to 2019.

In total, Asahi measured its group emissions across all three scopes at 8,623 kt-CO2 (with, of course, the bulk – some 8,028 kt-CO2 – being Scope 3).

The report drills down even further into emissions targets for Asahi subsidiaries, including for its domestic unit, its business in Australia and for Asahi Europe and International.

On packaging, the group wants to only use “materials for plastic containers that can be utilised effectively by 2025”.

Asahi defines “effective use” as “reusable, recyclable (including technical recyclability), compostable, thermal recyclable, etc”. The company said that stood at 99% by the end of 2023.

It also wants to achieve “a 100% conversion to recycled materials, bio-based materials, etc. for PET bottles” by 2030. By the end of last year, Asahi said it had reached a level of 25%.

Anheuser-Busch InBev

The world’s largest brewer has an “ambition” to be net zero “across our value chain” by 2040, a goal it set in 2021.

In the near term, Anheuser-Busch InBev has set a target of reducing its carbon emissions by 25% by 2025.

The Budweiser brewer’s most recently-published progress report on its ambition was issued in March 2023. AB InBev’s 2022 Environmental, Social & Governance Report said the company’s absolute emissions in Scopes 1 and 2 fell 2022 by 39.2% versus a 2017 baseline.

The Stella Artois brand owner also reported a 20.7% drop in its “emissions per hectolitre of production” against the same 2017 comparison when looking at its Scope 1, 2 and 3 emissions.

AB InBev’s report gave a breakdown of its Scope 3 emissions, which accounted for 86.7% of its emissions in 2022. It has, for example, calculated that just over 42% of the Scope 3 emissions comes from “packaging materials”. To try to bring these emissions down, the brewer is moving to increase the recycled content in its packaging, invest in “low-carbon” packaging and reduce the weight of the packaging, also known as “lightweighting”.

Focusing purely on the GHG emissions from packaging, some 48.2% comes from cans, with a further 31.4% from one-way glass, AB InBev noted.

The brewer highlighted the trial of a “low-carbon” can for its Corona brand in Canada. The can is made from aluminium with recycled ingot and produced from “carbon-free” hydropower, it said.

AB InBev wants all of its packaging to be “returnable or made from majority recycled content by 2025”. That figure stood at 77% in 2022.

Compared to the previous reporting year, the recycled content for cans increased slightly. However, compared to AB InBev’s 2017 baseline, the level of recycled content decreased in 2022. The company pointed to the “significant growth of our volume in cans since 2020”, which it said drove increased imports of can sheet amid a “lower availability” of recycled content. “We are working closely with our can sheet suppliers to increase recycled content,” the report read.

Another notable chunk of AB InBev’s Scope 3 emissions comes from keeping its products cool. Here, the Leffe brewer says it is looking to install “more efficient refrigeration with innovative cooling solutions”. It is also looking to “scale” the use of more renewable electricity “across our retailers globally”.

And the brewer also detailed its estimates for GHG emissions by crops. Unsurprisingly, the biggest portion (45.7%) comes from barley, followed by rice at 39.6%. “Agriculture,” AB InBev said, “represents 14.8% of our value chain emissions”. The company is investing in regenerative agriculture projects in countries including Mexico and Argentina.

Diageo

The world’s largest spirits business’ environmental targets include two goals on emissions for 2030.

By that year, the Johnnie Walker brand owner wants to “become net zero carbon in our direct operations”, covering Scopes 1 and 2.

On Scope 3, Diageo is aiming to “reduce our value chain carbon emissions by 50%” by 2030.

The group’s 2030 targets also include an aim for to only use renewable electricity at its “direct operations”.

Diageo is among a clutch of major drinks companies that formed the REfresh Alliance in 2024 to try to speed up the adoption of renewable energy in their supply chains.

On packaging, Diageo wants to see a 10% reduction in packaging weight and increasing the percentage of recycled content in its packaging to 60%.

In Diageo’s fiscal 2023 annual report, the company said it had cut the carbon emissions from its carbon emissions by 5.4%. It pointed to the “beneficial impact” of its biomass plants in east Africa and its use of liquid biofuel and renewable electricity.

Across Diageo’s whole value chain, the group saw its Scope 3 emissions fall by 1.2%. However, the Tanqueray gin owner added: “We remain behind our 2020 baseline by 20.7%.”

Emissions from packaging fell, Diageo said, amid moves to invest in the lightweighting of glass, removing cartons and switching to lower-carbon materials.

However, emissions linked to capital goods increased. The company said these included “investments in plants that enable our low-carbon transition”.

On sourcing, Diageo has a regenerative farming project in Ireland, aimed at reducing the carbon emissions of barley production. Last year, the company also started pilot ‘regen ag’ projects in Scotland and Mexico.

Overall, Diageo said its direct and indirect carbon emissions stood at 401,000 tonnes CO2e in its fiscal year 2023, compared to 424,000 the year previous.

On packaging, the Guinness owner cut the weight of its packaging by 4.4% year-on-year but said the amount it used was 14.9% above a 2020 baseline due to increased production.

Recycled content made up 39% of the packaging, a 1.2% fall on the previous fiscal year. Diageo pointed to a shortage of cullet, a feedstock for recycled glass, in the UK and North America. The company said: “We continue to face challenges in sourcing quality recycled glass and PET, though we are working with suppliers and industry peers to strengthen recycling infrastructure.”

Diageo’s 2030 emissions targets are approved by the SBTi. However, the company’s longer-term net-zero goal is classified as “commitment removed” on the SBTi website. Diageo, like dozens of other companies, is in the process of submitting an update to the SBTi and is aiming to have the target reviewed by the organisation within the next 12 to 18 months.

Heineken

The Dutch brewing behemoth has its ESG targets under its Brew a Better World 2030 strategy.

Heineken provided an update on its progress in its overall 2023 annual report.

Last year, the brewer’s target of being net zero in its “full value chain” by 2040 was approved by the SBTi.

Heineken also received SBTi backing for a Scope 3 target under the initiative’s Forest, Land and Agriculture (FLAG) guidance.

The FLAG scheme “provides the world’s first framework for companies in land-intensive sectors to set science-based targets that include land-based emission reductions and removals”, the SBTi says.

On the back of SBTi guidance, Heineken is aiming to “neutralise a maximum 10% of our unabated emissions by investing in high-integrity removal carbon credits”.

By the end of 2023, the Amstel brewer had cut its Scope 1 and 2 emissions by 34% compared to a 2018 baseline (and 19% versus 2022). Heineken pointed to gains in production and distribution. Some 77% of the electricity used in its direct operations is from renewable sources, up from 58% in 2022.

It had also reduced its Scope 3 emissions by 20% versus the same 2018 baseline.

From this year, in the wake of the FLAG award, Heineken will start reporting against updated 2030 scope 3 reduction targets. These will include a 30% reduction in the company’s Scope 3 agriculture emissions (FLAG) and a 25% cut in its Scope 3 emissions that are not linked to agriculture.

In 2023, 14.1m tonnes of CO2e of emissions were classified as Scope 3, down 12% on the year. Heineken said lower volumes meant it bought less packaging. It also pointed to “changes in methodology”. Group-wide, the company generated 15.3m tonnes.

Heineken says its work with suppliers includes a “low-carbon farming” programme to tackle carbon emissions and improve carbon sequestration, as well as supporting suppliers’ moves to move to renewable energy sources.

The brewer says it worked on almost 300 pilots in 2023, in markets including Mexico, Brazil, France, the UK and the US. It wants to hit 500 pilots by 2025 “and to scale the low-carbon farming programme across volume, crops and regions”.

So far, 13 of Heineken’s suppliers (which the brewer says makes up around 63% of its agriculture-related emissions) “are committed to SBTi, out of which five have already set targets”.

Turning to packaging (which accounts for 31% of Heineken’s emissions) the Strongbow brand owner has three 2023 targets. The group is aiming for 50% recycled content in its bottles and cans. The company wants 43% of its volumes to be sold in reusable formats. And it has a goal of 99% of its packaging to be “recyclable by design”.

The 2023 annual report states: “The majority of our packaging is already designed to be recyclable and is recycled at scale across the globe. Our two main challenges are to improve the recyclability of our caps and secondary packaging film. To do so we need to improve the designs and recycling at scale through market interventions. We will also ensure all innovations meet the recyclable by design standards and are further integrating this into our sustainable innovation process.”

Pernod Ricard

Pernod Ricard, home to brands including Mumm Champagne and Beefeater gin, has its own “roadmap to 2030”.

The France-based wine-and-spirits group says it is “committed” to halving “the intensity of our overall carbon footprint” by 2030. It has also pledged to follow a “net zero by 2050 trajectory”.

According to Pernod Ricard’s most recent annual report, which was published in November 2023, the company has cut its Scope 1 and 2 carbon-dioxide emissions by 12% since its 2018 fiscal year– and lowered its Scope 3 CO2 emissions by 18% over the same time-frame.

The Jacob’s Creek brand owner wants to reduce the “absolute value” of its Scope 1 and 2 emissions by 54% by 2030. It has also set a Scope 3 target, which is to cut the “financial intensity” of those emissions by 50% by the same year versus that fiscal 2018 baseline.

Despite some FMCG majors moving away from carbon-neutral projects, Pernod Ricard is investing in its production network with a series of “carbon neutral” programmes. It wants to make its Midleton distillery in Ireland “carbon neutral”, a change scheduled to be completed by 2026.

At Chivas Brothers, the group’s Scotch whisky arm, the business is aiming for “carbon-neutral distillation” by the same year. By 2023, Pernod Ricard has a target for its Absolut vodka brand to be carbon neutral. In Sweden, where Absolut is distilled, the group has been working on using hydrogen fuel to power a glass-melting furnace at the local site of packaging supplier Ardagh.

Across the Atlantic, the company is building a “carbon neutral” distillery for its Jefferson’s Bourbon brand in the US.

Pernod Ricard’s goals on packaging include a target for all its packaging to be “recyclable, reusable, or compostable by 2025”. Some 98% of the company’s packaging was classified as such according to the November 2023 annual report.

The company said it was “actively working towards increasing recycled content in glass to 50% and reducing virgin plastic by 5% by 2025 versus fiscal year 2020”.

In June 2023, Pernod Ricard defended the launch of a paper bottle for Absolut amid “greenwashing” claims from industry watchers. The bottle was launched in 22 Tesco stores in the UK city of Manchester.

2023 also saw the company acquire a minority stake in circular packaging company EcoSpirits. Pernod Ricard had been trialling a closed-loop packaging concept in south-east Asia using technology developed by EcoSpirits.

Stock Spirits Group

Pan-European distiller Stock Spirits has a target to cut its Scope 1 and 2 greenhouse gas emissions by 42% against a 2015 baseline by 2030.

The Clan Campbell whisky owner is looking to reduce its Scope 3 emissions by “approximately 20%”.

Stock Spirits plans to set its Scope 3 “intensity-based reduction target” by 2025. The goal will be “equivalent to approximately a 20% absolute reduction”

The company plans to set its final reduction targets for SBTi validation in 2025.

The Scope 3 target does not include the group’s new distillery in the Polish city of Lublin distillery or M&A.

Stock Spirits completed the construction of the factory in Lublin earlier this year, a site the company said is the biggest distillery in Poland.

In August 2024, the Sierra Tequila owner issued its 2023 Sustainability Report. The company said it had cut its Scope 1 GHG emissions by 27.2% when compared to 2015 to 26,587.3 tCO2e.

On Scope 2, Stock Spirits said it had achieved a 7.8% reduction of its “location-based” emissions to 8,573.6 tCO2e and a 96.9% fall in “market-based” emissions to 353.3 tCO2e.

The group said the drop in market-based emissions had been “mainly related to switching to renewable energy sources”. It has a target for all of the electricity used in its production sites to come from renewable sources in 2025.

Treasury Wine Estates

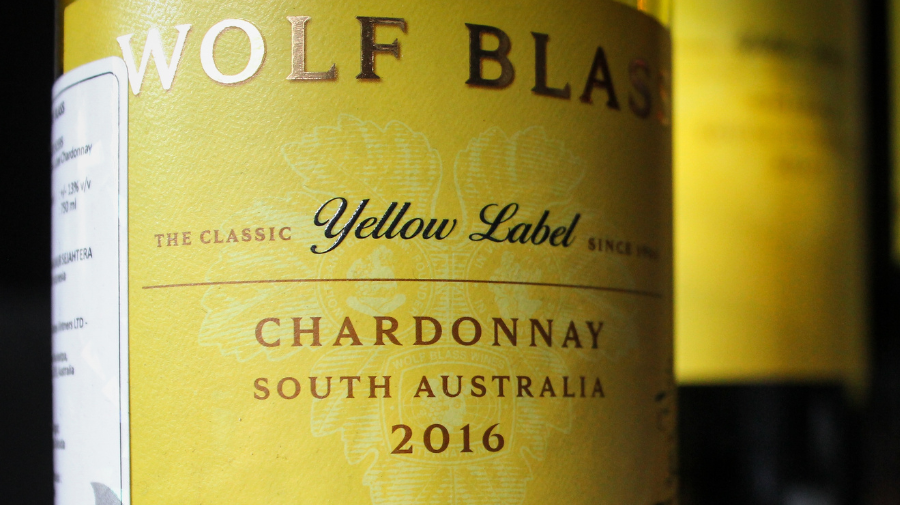

Australia-based Treasury Wine Estates, home to brands including Penfolds and Wolf Blass, has an over-arching goal to reach net zero for Scope 1 and 2 emissions by 2030.

In the listed group’s 2024 financial year, it generated 16kt CO2e of emissions under those two scopes – accounting for 3.8% of its total emissions.

As you’d expect, TWE’s Scope 3 emissions made up more than 90% of its emissions during the 2024 fiscal period, as per a report issued by the company covering the year.

The Daou wine brand owner provided a breakdown of its Scope 3 emissions – with 27.2% defined as coming from “TWE operations” and 26.4% from “bottling and packaging”. A further 18.1% is classed as from “logistics, warehousing and distribution”.

TWE says it reports its Scope 3 emissions with a lag of one year due to the time it takes to source data. In the company’s 2022 fiscal year, the emissions stood at 496.1kt CO2e and fell to 404.8kt CO2e in the 2023 financial year.

“We’re engaging with our supply chain to encourage decarbonisation and further

understand our associated emissions profile (Scope 3), which is a longer-term programme of work, given the complexities involved,” the report states.

During the most recent year under review, TWE said it sent 110 requests to suppliers for information on their emissions. The requests covered “36% of supplier spend but approximately 60% of emissions”. Some 19 suppliers took part in the survey.

“Many of our suppliers are in the early stages of emissions data collection or have not fully accounted for their scope 1 and 2 emission footprints and were unable to provide sufficient quality data,” TWE said. “A total of 19 suppliers were able to participate in the survey, indicating there is more work to do to build capability and reporting system maturity among our suppliers.

Rémy Cointreau

According to its latest Corporate Social Responsibility (CSR) targets, Rémy Cointreau plans to cut its CO2 emissions on scopes 1, 2 and 3 by 5% across 2023-2024, compared to 2020-2021.

By 2030, the group looks to reduce CO2 emissions from scopes 1, 2 and 3 by 27% by 2030. It also aims to cut 90% of CO2 equivalent from the total business (versus a 2020-2021 baseline), by 2050.

That same year, the group also plans to have reached a stage where it is using 100% renewable energy across its manufacturing sites. Out of its eight production locations, five presently use renewable energy, equating to 38% renewable energy being used across the business.

In addition, the Louis XIII distiller intends to cut 25% of CO2 emissions connected to packaging by 2030.

In November, French spirits group Rémy Cointreau announced plans to use neutral alcohol made from legumes in its Cointreau orange liqueur in a bid to reduce its carbon footprint.

From 2026, the company is to source a minimum of 20,000 hectolitres of the legumes-based alcohol a year. The amount equates to 40% of the neutral alcohol needed for Cointreau.

Rémy Cointreau has picked French agricultural ingredients producer Intact to supply the ingredient. The group manufactures “low-carbon ingredients from regenerative agriculture”.

The Telmont Champagne maker said it expected the move to 1,200 tons of CO2 equivalent from the Cointreau spirit, helping to reduce its total carbon footprint by 5%.

The alcohol is to be made at Intact’s site in Baule, which is under construction. It is set to start operations in the second half of 2025.

The ingredient, called Pulse, is being used in Cointreau because the unit “uses the highest volume of neutral alcohol and therefore represents the most interesting opportunity”, a Rémy Cointreau spokesperson said.

They declined to say which ingredient Intact’s alcohol would replace.