UK alcohol producers have hit out at the Government’s decision to raise duty rates, announced today (26 November).

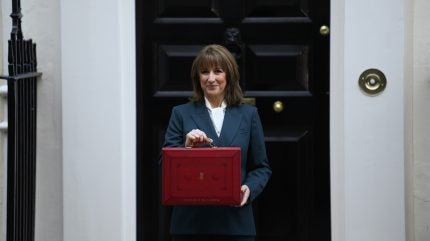

As part of its Autumn Budget, the Government has confirmed that all duty on alcohol will increase with the Retail Price Index (RPI) measure of inflation that comes into effect from February.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

“This decision balances the important contribution of alcohol producers and the hospitality sector to the UK’s culture and economy, with the duty’s role in reducing alcohol harm,” it said in its policy paper outlining the move today.

Alongside the news of the duty hike, the Government also said it would be uprating Small Producer Relief discounts.

Miles Beale, chief executive of The Wine and Spirit Trade Association (WSTA), said: “This Budget has been dubbed a death by a thousand cuts, and for wine and spirit businesses those cuts run deep. Our members are still reeling from the tax hikes introduced in February, and the additional burden of the costly new glass tax, known as EPR.

“Coupled with rises in National Insurance, increases to the minimum wage and business rates, it is no surprise that wine and spirit producers – along with our beleaguered hospitality sector – feel under sustained attack.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBeale added that the move was “typically disappointing and shortsighted”, adding that the duty increase “will only prolong the doom loop”.

According to the WSTA, the RPI has been set at 3.66% which will mean duty will increase by 11p on a bottle of Prosecco, 13p on a bottle of red wine, and by 38p for a bottle of gin.

Mark Kent, chief executive of the Scotch Whisky Association (SWA) meanwhile said Scotch producers were “disappointed” about the decision, and stressed the move would bring “huge additional pressure on a sector suffering job losses, stalled investment and business closures”.

“Put simply, the government cannot expect the Scotch Whisky sector to just keep delivering growth, both at home and on the world stage, if the conditions which support growth are not nurtured”, he said.

Alcohol trade bodies had been urging the UK government not to increase duty. Earlier this month, the WSTA, SWA, and Society of Independent Brewers, among other associations had called on the exchequer secretary not to raise duty rates, as the whole sector faces “significant challenges”.

Trade association SIBA said the government’s decision today was “a bitter blow for beer drinkers, community pubs and small breweries”.

“Instead of supporting a sector already under immense pressure, the chancellor has chosen to increase beer duty on top of a raft of other tax rises. She had a real opportunity to build on last year’s progress by extending draught relief – a move that would have ensured beer sold in pubs carried a lower rate of duty – but she chose not to act.”