US-based Lucky Energy Drinks has secured a “six-figure” investment from private equity firm InvestBev.

Richard Laver, CEO and chairman of Lucky Energy Drinks, said InvestBev’s “credibility, experience, and strategic insight will be instrumental” as the Texas-based firm seeks to grow,

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

In a statement, InvestBev said the investment fits its plan to expand into “fast-growing” non-alcoholic categories in response to evolving consumer demand.

InvestBev founder and chairman Brian Rosen said Lucky Energy’s “product, brand identity and mission align with where the global drinker is headed”.

He said: “Add to that a seasoned leadership team with decades of industry experience, and it became a very easy decision for us to get behind them.”

The Chicago-based investor, with over 60 brands in its portfolio, has traditionally invested in the spirits sector. With the industry experiencing a slowdown in the US, particularly in Bourbon sales, InvestBev is exploring other avenues for growth.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataDespite these industry challenges, InvestBev continues to put its funds to work, and remains upbeat about the opportunities to invest across the US drinks industry.

“We are continuing to invest. We are bullish. This is a time – if you look at whether it’s a UK recession, an EU recession, a US recession, or any of the above struggling in any way from a geopolitical standpoint – to go to the fire,” Rosen told Just Drinks on the GlobalData Consumer podcast on 15 May.

The investment from InvestBev follows Lucky Energy’s “over-subscribed” Series A1 round in March, which helped the firm raise $14.2m.

The funding round was led by venture capital firm Maveron and saw the participation of DMG Ventures, a VC fund backed by UK media group Daily Mail and General Trust.

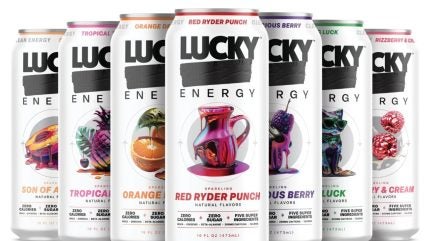

Lucky Energy offers a range of flavoured sugar-free energy drinks including Son of a Peach, Orange Drizzle, Red Ryder Punch, and Bodacious Berry.

The company, formerly known as Lucky F*ck, had received $4m in seed funding from Imaginary Ventures in December 2023.

Established in 2023 by Richard Laver, Lucky Energy’s products are on sale in 10,000 outlets. Retail stockists include 7-Eleven and Circle K. It has a target of taking listings to 15,000 this year, with new customers including Kroger, Albertsons and Ahold Delhaize.