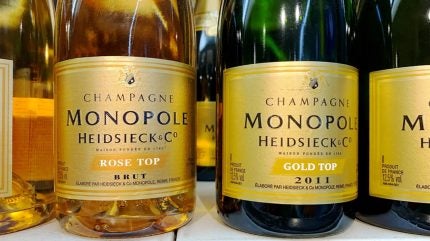

Lanson-BCC is in “exclusive negotiations” to acquire Heidsieck & Co. Monopole from Champagne rival Vranken-Pommery.

Last week, Vranken-Pommery said it had started the process to offload Heidsieck & Co. Monopole to majority shareholder Compagnie Vranken.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

However, in a brief statement released yesterday (24 September), Vranken-Pommery said it was in talks to sell the business to Lanson-BCC.

Subject to the approval of both companies’ boards, a deal is expected to be signed on 1 October.

Lanson-BCC declined to comment when approached by Just Drinks.

In 2024, Heidsieck & Co. Monopole accounted for 18% of the revenue Vranken-Pommery generated from Champagne.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataVranken-Pommery’s group revenue fell 10.2% to €304m ($357.5m) in 2024. Revenue from the company’s Champagne division dropped 9.5% to €263.2m.

The company, which oversees 2,600 hectares across four vineyard sites, is also negotiating the disposal of unspecified land and property in the Camargue region of southern France.

Beyond Champagne, Vranken-Pommery’s portfolio spans Port and Douro wines in Portugal, vineyards in southern France, and an English sparkling wine operation.

In the first half of 2025, the company generated a turnover of €109.3m, down 0.2% on the opening six months of 2024.

The group described the result as “stable sales in a Champagne market that was still slightly down”.

Vranken-Pommery’s half-year operating income fell 7.2% to €13.7m. It made a first-half net loss of €1.4m versus one of €1.9m in the corresponding period a year earlier, helped by a fall in financial expenses.

Earlier this month, Lanson-BCC booked better revenues but falling earnings for the first half of 2025 amid higher production and finance costs.

Revenues rose almost 5% due to a “favourable price/product mix” and despite Lanson shipping lower volumes year-on-year.

First-half revenues stood at €92.1m ($107.8m), an increase of 4.8% year-on-year.

Export sales came in just under half of the group’s revenues against 52.4% in the first six months of 2024. The business pointed to lower shipments to the US and Asia.

However, Lanson’s gross margins fell and its income from ordinary operations slid 11.9% to €10.9m.

Amid a 15.4% rise in finance costs, the company’s net income tumbled 49.7% to €1.9m.