UK functional juice shot maker Moju embarked on its first venture outside its home market earlier this year, launching into France through an exclusive, six-month listing with Carrefour.

Carrefour will stock four SKUs, including two of Moju’s cold-pressed variants, ginger and turmeric, both available in a 420ml multi-shot ‘dosing bottle’ take-home format, and an on-the-go 60ml version.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Moju said the move came in response to “the rising interest from French consumers looking to incorporate functional foods, like ginger, into their diets to support their health and wellbeing”.

The products are already available across the country, focused on urban hubs such as Paris and Lyon in Carrefour hypermarkets, supermarkets and convenience stores.

Privately-owned Moju was founded in 2015 by Charlie Leet-Cook and Rich Goldsmith. The business was financed by the founders before but receiving support from undisclosed investors.

Moju refrained from disclosing its main investors, provide a breakdown of the shareholding structure or give Just Drinks detailed financial figures.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataHowever, the company provided data from Circana, which it said showed Moju products are stocked at more than 12,000 points in the grocery channel. Figures from Circana showed Moju’s value sales rose 48.3% in the 52 weeks to 16 March. Volumes were up 64.5%.

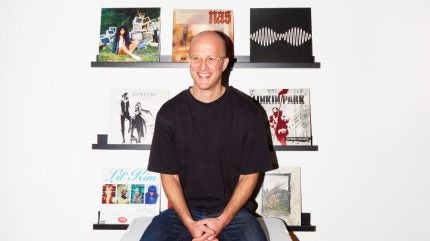

Just Drinks sat down with Leet-Cook to discuss the company’s expansion strategy and the emerging functional shots category.

Eszter Racz (ER): Why did Moju choose France as its first venture outside the UK?

Charlie Leet-Cook (CL-C): We feel there’s a lot of opportunity in functional shots across Europe as a whole. We think there’s a lot of ubiquity in our product. What excited us most about France is the opportunity to go in and really recreate what we’ve done in the UK. In the UK, we pioneered the functional shot category. It was an opportunity for us to establish and grow; we did the category defining and category building. We see a similar opportunity to do that within France. The market within France is in its sort of nascent, early stages.

ER: Are you going to extend the six-month contract with Carrefour, either with exclusivity or without it? What are your expansion plans for France?

CL-C: The six-month exclusivity is just an opportunity for us to show our commitment to Carrefour, and vice versa. After that, we are planning to expand. I think very similarly to what we’ve done in the UK, we see the opportunity to use the playbook that we’ve created, honed, and perfected in our home market, and roll that out, taking into account that every market has its own nuances and differences. So, yes, we’ll be expanding our distribution, for sure, within France, over and above.

ER: What do you think about France’s market for functional shots in comparison to the UK?

CL-C: I think there are a lot of similarities to what we have seen in the UK, if you were to bring it back to consumer trends. And I don’t think this is France-specific, I think in the broader European continent, there is a trend to focus on health and well-being and on sugar reduction. People are time poor. Convenience is something that they are looking for. And then you’ve got fresh ingredients. And there is an increasing awareness and concern around UPS.

And when you look at France specifically, they’re big on food, right? They love quality! They are really big on quality of ingredients, provenance. We see that as a brilliant fit for the Mojo brand, and our product.

ER: Who is your target consumer?

CL-C: We categorise our target consumer into three different buckets. The primary one is what we call the “Get through crew”. That’s the approximately 35- to 49-year-olds, young family, busy work life, and you’re just doing everything you can to get by. Anything that’s there to help support your health and well-being is a huge help. I would say that’s our primary target market in terms of consumer shopper profile. Myself and my co-founder Rich [Goldsmith], we also definitely fall in the “Get Through Crew bucket.

And then we also have a slightly older demographic, who are people very much focusing on increasing health, just putting stuff into their daily consumption.

We also have the ‘Health Hackers’. That’s a younger age group, the 18- to 34-year-olds. Fit, active, healthy, very busy and committed to work but also probably more switched on and aware of what they should be consuming to maintain a healthy, nutritious diet.

ER: As you make an effort to expand, does Moju think the popularity of health consciousness will grow and therefore you can grow your customer base with it, or will you eventually venture outside of the health and functionality category?

CL-C: I think we’ll always stay in the health and functionality field. Right now, the focus is definitely on our current product set. Especially when you look at France, we’re going out there and establishing our brand. We’ve got a very high-performing range of products. So the opportunity for us is just to go and focus on delivering them to the French market and getting the French shoppers and consumers really familiar with them.

JD: Are you looking to expand your distribution network? Do you have deals lined up?

CL-C: We’re always looking to expand our distribution but I think it has to be the right distribution at the right time. I’ll bring it back to again, how we’ve built the business within the UK. We’re very big on taking an evergreen approach, so you won’t get us ever rushing or chasing distribution. It has to be the right time to launch and win that distribution, and it’s the same approach we’re taking at the moment. In terms of outside of the UK, France is our sole focus.

We’re very big on focus. We believe it’s a big contributor to why we have been so successful in the UK. We’ve just been resolutely focused in pioneering and building the category and we’re looking to do the same in France, so there will be additional distribution, not something that we can talk about probably right now, because we’ve literally only just launched into France but you’ll see expansion later on for sure.

ER: You are present in gyms? Do you have further plans outside the grocery channel?

CL-C: Impulse was where we established our business. We built the business in independent coffee stores, independent convenience stores and independent health stores. We see that channel as hugely important, and always will be. Even though it’s a smaller part of the business and will continue to be a smaller part of the business, we see it as a very important part. I think we look at the omnichannel sales approach. Each channel should have a really specific purpose and, for us, impulse is all around driving trial and discovery. It’s a great place for shoppers to find an experience at their point of need for the first time. You are at the gym, and you want that pick me up, that boost [and] having a ginger shot is great. Or maybe you want something anti-inflammatory, and having a turmeric shot is brilliant. Putting the product at the consumer’s point of need is really powerful. We found that to be very effective.

Look at the independent coffee chains as well. We also position the ginger shot as a great caffeine-free pick-me-up. You have a lot of people looking to reduce their overall caffeine intake. That product plays really well there.

Then the intention for the grocery channel is for it to be our main volume driver, and that’s the channel for loyalty, where people can find and experience our dosing bottles. Then we obviously have D2C as well but D2C is different. It’s a big play on loyalty, with a focus on subscription. It’s a great community platform for us. We can test products through it, test the innovation, and get live feedback.

ER: Where do you see growth opportunities for Moju both in the UK and France?

CL-C: The reality is that in the UK, penetration of the functional shots category is still very low. In France, it’s even lower, much, much lower. It’s at the real early stages. The big focus for us is driving trial and awareness. There’s no better way for people to experience the product and for us to sell it than for people to trial it. Sampling can be a big, big thing for us and any way we can drive trial of the product.

ER: Do you think it’s an advantage or a disadvantage that the category of functional shots is relatively new? Is that good for you, or is it a hindrance to your business?

CL-C: Both is probably the answer there, right? The challenge is the opportunity. I would say functional isn’t that new either in the UK now. I think functional overall as a category, you’re probably looking at about half a billion [pounds]. It’s pretty established.

Some [countries] tend to sort of lag behind the UK in health trends and functionals, and France is definitely one of those. I think maybe in the early days it’s partly going to be a challenge but that’s great because we get to go in and really lead the category and establish it. Yes, it’s a lot of hard work but it’s also a massive opportunity. I think we have proven [that] right by all that we’ve achieved to date and our growth rate.

ER: Do you think the category still has space to grow substantially?

CL-C: Yeah, massive headroom is how I would summarise that. I mean, we think in the next two years in the UK alone, [functional shots] will be a £100m ($134.1m) category and there’s still a huge amount of headroom to go after that as well.