US energy-drinks firm Nutrabolt has made another investment in Bloom Nutrition, the supplements and active-nutrition business.

Nutrabolt, which first backed Bloom Nutrition last year, has announced a “significant new investment” in the California company.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Doss Cunningham, Nutrabolt’s CEO, would not disclose the stake the group now has in Bloom Nutrition.

However, he confirmed Nutrabolt has now invested over $200m in the business. In January last year, Nutrabolt’s first investment in Bloom Nutrition saw the company spend $90m for around 20% of the functional-drinks, creatine-gummies and whey-protein supplier.

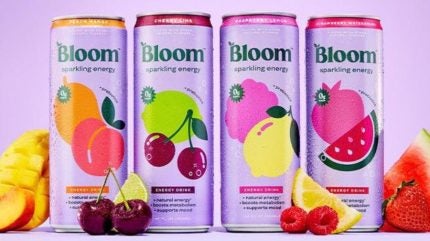

In July, Bloom Nutrition added to Bloom Pop, a range of prebiotic sodas, to its range. The company launched an energy-drinks line, Bloom Sparkling Energy, last year.

“With the breakout success of Bloom Pop and a record-breaking year for Bloom Sparkling Energy, the brand’s momentum presents a powerful step-change growth opportunity for Nutrabolt,” Cunningham said.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataNutrabolt said it will continue to work closely with Bloom Nutrition founders Mari Llewellyn and Greg LaVecchia, as well as the company’s management team, who will “still drive the brand and lead its strategic vision”.

LaVecchia, Bloom Nutrition’s CEO, said: “Nutrabolt has been a valuable partner – fully aligned in our mission and a genuine champion of our brand. With this expanded partnership, we’re excited to enter our next phase of growth and create something truly meaningful together.”

Nutrabolt, based in Austin in Texas, is a functional beverage maker that owns the energy drinks brand, C4 and dietary supplement labels Xtend and Cellulor.

Three years ago, Keurig Dr Pepper (KDP) invested $863m for a 30% stake in Nutrabolt.

The “strategic partnership” included a long-term sales and distribution agreement for Nutrabolt’s energy drink brand C4, KDP said in a statement at the time.

Last month, Keurig Dr Pepper struck a deal to acquire Dutch coffee company JDE Peet’s for €15.7bn ($18.36bn) and then split the combined business into two.

One of the new companies will focus on coffee. With approximately $16bn in combined annual net sales, Global Coffee Co. is poised to become the “world’s largest pure-play coffee company”, KDP said.

Beverage Co., based in Frisco, Texas, will operate as a “scaled challenger” in North America’s $300bn refreshment beverage market, with $11bn in annual sales, the company said.